STATUTORY CHANGES FOR MTD 2015

As proposed in the budget 2015, the statutory changes for MTD 2015 are as follows:

1. REDUCTION IN INCOME TAX RATES AND CHANGE IN INCOME TAX STRUCTURE

a. Income Tax For Resident Individual

- Individual income tax rate will be reduced by 1 to 3 percentage points.

- Individual income tax will be restructured whereby the chargeable income subject to the maximum rate will be increase from exceeding RM100,000 to exceeding RM400,000.

- The maximum tax rate for year 2014 at 26% will be reduced to 24%, 24.5% and 25%.

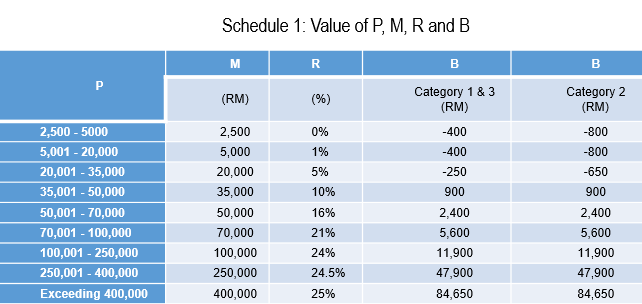

Therefore, the new tax rate value of P, M, R and B for MTD Computerised Calculation schedule 1 as follows:

b. Income Tax For Non-Resident Individual

- Non-resident individuals’ income tax rate would be reduced by 1% from 26% to 25%.

2. INCREASE IN DEDUCTION FOR MEDICAL EXPENSES INCURRED FOR SERIOUS DISEASES

Presently, a resident individual taxpayer is given a deduction up to RM5,000 for medical expenses incurred for treatment of serious diseases for the taxpayer, his/her spouse and his/her children.

As proposed in the 2015 Budget, the deduction for medical expenses incurred for serious disease be increased to RM6,000.

3. INCREASE IN DEDUCTION FOR DISABLE CHILD

Presently, a resident individual taxpayer with disabled child as certified by the Department of Social Welfare is eligible for a deduction of RM5,000 for each disabled child.

As proposed in the 2015 Budget, the deduction be increased to RM6,000.

4. INCREASE IN DEDUCTION FOR PURCHASE OF BASIC SUPPORTING EQUIPMENT FOR THE DISABLED

Presently, a resident individual taxpayer is given a deduction up to RM5,000 for the purchase of any necessary basic supporting equipment for the use of the disabled taxpayer, his/her spouse, children and parents.

As proposed in the 2015 Budget, the deduction be increased to RM6,000.